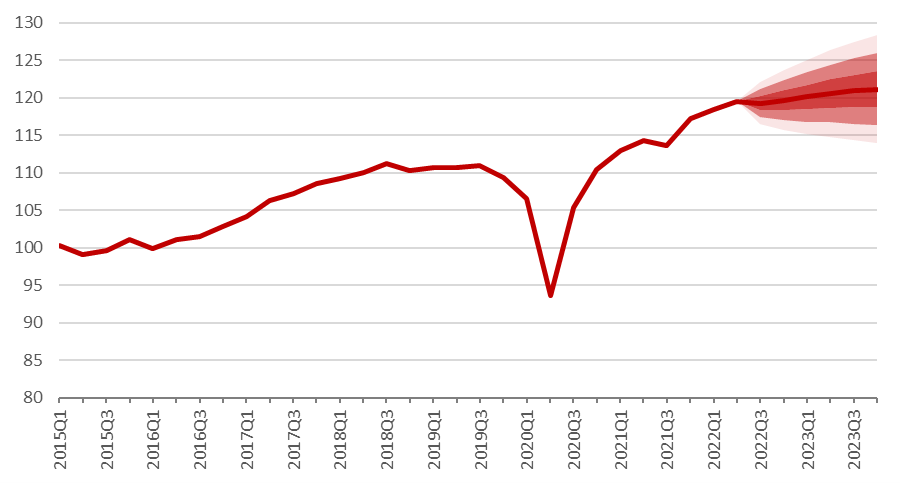

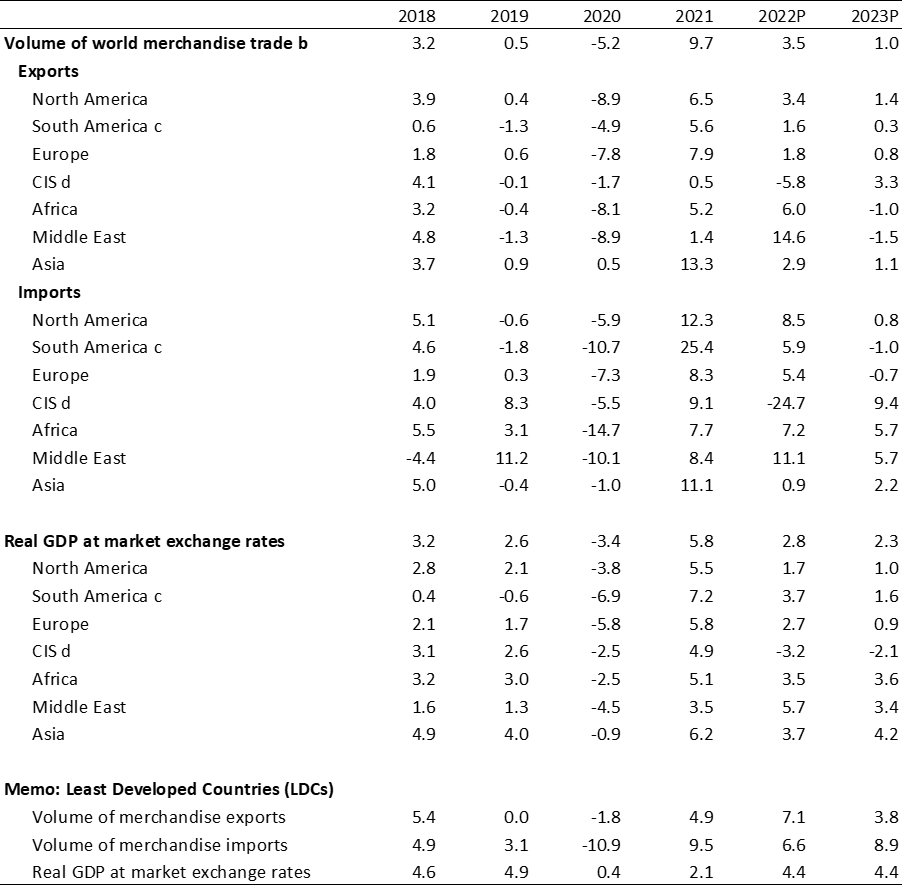

As the global economy continues to grapple with the effects of the COVID-19 pandemic, world trade is forecast to slow in the second half of 2022 and remain subdued in 2023. According to the World Trade Organization (WTO), global merchandise trade volumes are expected to grow by 3.5% in 2022, a slight improvement on the original forecast of 3.0%. However, the outlook for 2023 is less positive, with WTO economists now predicting a 1.0% increase—a significant decrease from the April forecast of 3.4%.

Expected Global Trade Volume Upticks in 2022, Slowing in 2023

The world merchandise trade volume has been revised down for 2023, from 3.4% to 1.0%. This is a significant drop from the projected 3.5% growth for 2022, indicating a slowing of global trade activity. The revision is attributed to the effects of the COVID-19 pandemic, which has disrupted the global supply chain and caused an economic downturn. The World Trade Organization (WTO) has urged countries to take steps to mitigate the impacts of the pandemic, such as relaxing trade barriers and strengthening digital infrastructure. It is hoped that these measures will help to revive trade activity and reduce the expected slowdown in global trade.

Global Economy Set to Grow, but at Slower Pace than Previously Projected

As the global economy continues to recover from the economic effects of the pandemic, the International Monetary Fund (IMF) has revised its prediction for the growth of World GDP at market exchange rates over the next two years. According to their latest forecast, they anticipate that World GDP will increase by 2.8% in 2022 and 2.3% in 2023. This is a slight revision down from their earlier prediction of 3.2%. This is a positive sign that the global economy is on the road to recovery, and the IMF is optimistic that the rate of growth will continue to improve in the coming years. This is good news for countries around the world as they look to rebuild their economies and move forward.

The Rippling Effects of Multiple Shocks on Trade and Output

The global economy is facing a series of shocks that are weighing down on trade and output, including the war in Ukraine, high energy prices, inflation, and monetary tightening. The war in Ukraine has led to a disruption in trade between the two countries, while high energy prices have led to an increase in production costs. Inflation has resulted in higher prices, which has dampened consumer demand, while monetary tightening has restricted economic growth. The combination of these shocks has caused a decrease in global trade and output. In order to mitigate the negative effects of these shocks, governments and central banks must work together to promote economic growth and stability. A coordinated effort to support trade and investment, boost consumer spending, and reduce inflation will be necessary to get the global economy back on track.

Q2 Struggles: CIS Region Sees Double-Digit Declines in Exports and Imports

As the pandemic continues to ravage nations around the world, the CIS region saw a sharp decline in exports and imports in the second quarter of 2020. According to data released by the CIS Statistics Committee, exports of merchandise fell 10.4% quarter-on-quarter, while imports dropped even further, by 21.7%. This sharp decrease could be attributed to the impact of the pandemic on international trade and the region’s already sluggish economy. With many countries facing a recession as a result of the pandemic, it’s likely that these numbers could remain low for some time. Moving forward, it will be important for the CIS region to find ways to stimulate their economy and encourage international trade in order to help the region recover from this difficult period.

The Middle East Set to Lead the Global Trade Market in 2022

The Middle East is poised to become one of the strongest trade markets in 2022. According to the World Trade Organization, the region will experience the highest growth in export volume of any region, with a 14.6% increase. On the import side, the Middle East will also experience a growth of 11.1%, further solidifying its importance in the global trade economy. The booming trade market in the Middle East is a great opportunity for businesses to expand and benefit from the region’s resources and products. With more investment and resources, the Middle East will be a strong leader in the global economy in 2022.

b. Refers to average of exports and imports.

c. Refers to South and Central America and the Caribbean.

d. Refers to Commonwealth of Independent States (CIS), including certain associate and former member States.

Note: These projections incorporate mixed-data sampling (MIDAS) techniques for selected countries to take advantage of higher-frequency data such as container throughput and financial risk indices.

Sources: WTO for trade, consensus estimates for GDP.

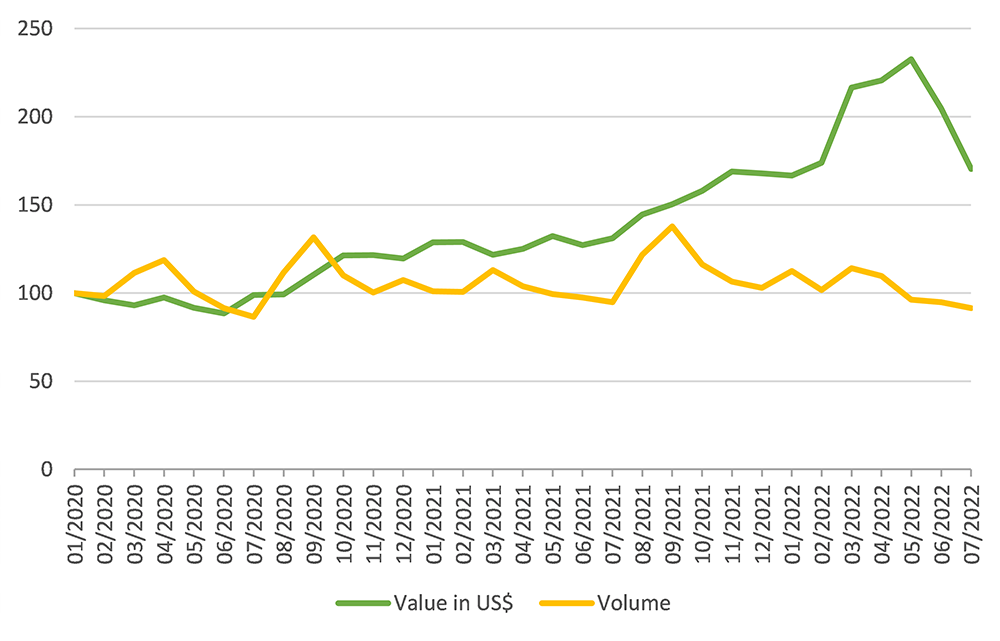

A Look at the Boost in US Merchandise Trade: 17% Increase in Q2 2022

It appears that global trade is on the rise, as the value of merchandise trade in U.S. dollars saw a 17% increase year-on-year in the second quarter of 2022. This is a very positive sign for the global economy, as it indicates that more countries are engaging in international trade and that businesses are doing well. With the increase in trade, more goods are reaching more people, which is sure to have a positive impact on the global economy. This is a trend worth watching, as it could be indicative of a stronger global economy in the future.

Skyrocketing Prices: Energy Up 78%, Food Up 11%, Grains Up 15%, Fertilizers Up 60%

The cost of energy rose dramatically in August, with a 78% year-on-year increase. This increase was far greater than the 11% rise in food prices, the 15% jump in grain prices, and the 60% increase in fertilizer prices. This sharp spike in energy prices has had a ripple effect throughout the economy, as businesses and households alike are feeling the strain of rising costs. With no end in sight to the current economic difficulties, consumers should be prepared to pay more for energy, food, and other essentials in the coming months.

Footnote

In conclusion, the WTO does not provide a forecast on services trade but data from Chart 6 and the OpenSky network indicate that travel and transport are its most dynamic components. This summer, daily commercial flights have finally surpassed pre-pandemic levels but have recently decreased again. It is yet to be seen if this is only temporary or indicative of a longer-term trend.