Capacitive pressure sensors measure pressure by detecting the changes in electrical capacitance caused by the movement of a diaphragm. This diaphragm is usually made of a flexible material such as silicone or polyester and is connected to an electrical circuit. When pressure is applied to the diaphragm, it changes the electrical capacitance of the circuit, which is then converted into a pressure reading. Capacitive pressure sensors are used in a variety of applications, including medical devices, industrial process controls, and automotive systems. They are reliable, accurate, and cost-effective solutions for measuring pressure in many different environments.

How does it works?

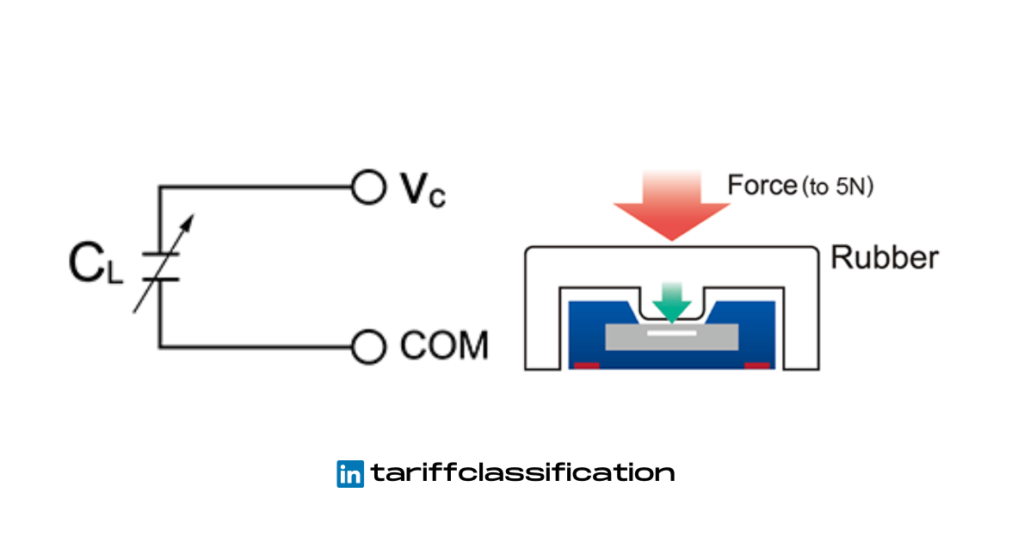

Changing the distance between the two plates of a capacitor will cause a corresponding change in the capacitance of the capacitor. This means that one of the plates can be made into a diaphragm that is sensitive to changes in pressure. This will cause the distance between the plates to change and thus, the capacitance. An example of this is a capacitive pressure sensor, which is typically made up of one pressure sensitive diaphragm and one fixed plate. To measure the capacitance, it can be included in a tuned circuit, consisting of an inductor and the capacitive sensor. This can either be used to alter the frequency of an oscillator or the AC coupling of a resonant circuit.

Tariff Classification

The applicable subheading for the Capacitive Force Sensor is 9031.80.8085, HTSUS. This heading provides for “Measuring or checking instruments, appliances and machines, not specified or included elsewhere in this chapter; profile projectors; parts and accessories thereof: Other instruments, appliances and machines: Other: Other.” The general rate of duty for this subheading is Free, meaning that there is no customs duty charged on this item when imported into the United States. This means that the Capacitive Force Sensor can be imported at a lower cost, allowing businesses to save money.

Law and Analysis

The Classification of goods under the HTSUS is a complex process that must be followed to ensure the proper classification of goods. The General Rules of Interpretation (GRI) provide a framework for the classification of goods. GRI 1 states that classification must be based on the headings of the tariff schedule and any relative section or chapter notes. If the goods cannot be classified solely on the basis of GRI 1, then the remaining GRI can be applied. This Capacitive Force Sensor does not fall under the tariff code 8532, which is for Electrical capacitors, fixed, variable or adjustable (pre-set); parts thereof. Therefore, the GRI must be used to correctly classify this item.